It also is easier to identify problems, such as missed automatic payments, incorrectly assessed fees, fraudulent charges and even your own mathematical mistakes, when you have a regularly balanced checkbook.īalancing your checkbook used to be a chore reserved for a specific time each month: after receiving your monthly paper statement from the bank.

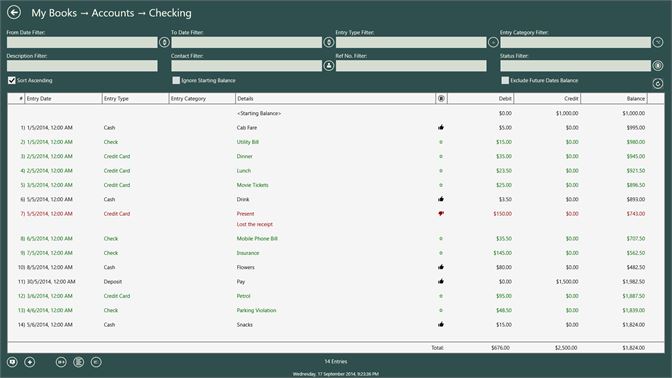

#Checkbook register software how to#

Here’s what you need to know about how to balance a checkbook in a paperless world. But whether you were a master checkbook balancer in the time of paper or are a digital native who didn’t realize paper statements were once a thing, you may not know exactly how to reconcile your accounts. However, even though the paper-and-pencil aspect of checkbook balancing has mostly gone the way of the dodo, the process is still a necessary part of maintaining your checking account. Now that all of your transactions are available immediately via your bank’s online portal or mobile app, you may assume that balancing your checkbook is the kind of skill that’s lost all usefulness, like knowing how to use a pencil to rewind an unraveled cassette tape. Back when receiving paper statements from your bank was the norm rather than an anomaly, taking the time to reconcile your checking account records with your statement each month was an important part of keeping your finances healthy.

0 kommentar(er)

0 kommentar(er)